Every generation charts its own path to building wealth. And along the way, these experiences shape not only their approach to growing their money and wealth management, but also how they choose to pass that wealth on to the next generation.

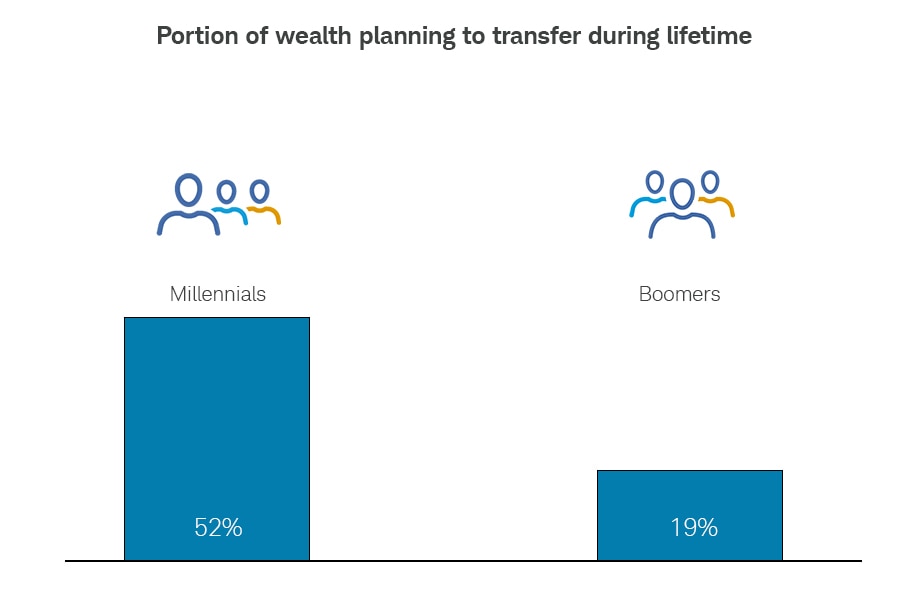

The 2024 Schwab High Net Worth Investor Survey, a study of more than 1,000 wealthy Americans, revealed clear generational differences in these decisions about generational wealth transfer. One of the most revealing findings was that baby boomers had a different mindset than their Gen X and millennial counterparts, who are more than twice as likely to prefer sharing their wealth with the next generation during their lifetime.

But before you start imagining a generational tug-of-war over inheritance, keep in mind that different gifting approaches are tied to unique generational values.

The boomers: transferring work ethic, legacy, and values—not just money

Baby boomers (born between 1946 and 1964) are the generation that built much of what we know today. They benefited from coming-of-age in a strong, and growing economy. For many baby boomers, wealth-building wasn’t just about accumulation; it was about securing a better future for their families.

Charlie Gregory, 77, former president of Benedictine University, said his experience growing up shaped his approach to building wealth as an adult.

“As much as my parents wanted to offer me the possibility of a future without the hardships, sacrifices, and struggles they’d experienced all their lives...they were unable to do so,” explains Charlie. “However, I was blessed they taught me the importance of a good work ethic and to seize opportunities that came my way. I’ve also been fortunate to have good mentors who were ethical, caring, and took time to guide me along the way.”

Charlie’s perspective is familiar to many baby boomers: they didn’t inherit much, but they worked hard to make sure their children had more.

“I want my children and grandchildren to have some of the same experiences as I did, but at the same time, not the same struggles,” Charlie added. “I want them to be able to invest in themselves, in their vision and dreams, without too many financial worries.”

For Charlie, it’s all about values and mentorship. Many baby boomers have this view when it comes to inherited wealth and leaving a legacy. Their focus is not just setting up financial inheritances for their family members, but also instilling values and educating the next generation for success.

“My children and grandchildren are in what I call the ‘trying to make it’ stage of life,” Charlie shared. “As they get older, I'm constantly encouraging as well as questioning them about their ‘tomorrows’ and how they intend to not only grow professionally, but financially.”

This active role in guiding the next generation financially shows a unique generational perspective: baby boomers want to teach their kids, not just hand over money. After all, wealth isn’t just about dollars—it’s about mindset. And it will understandably impact their approach to what is referred to as The Great Wealth Transfer, or the massive shift of wealth from baby boomers to younger generations.

The millennials: transferring flexibility, resilience, and a head start—not just assets

Cut to the millennials (born between 1981 and 1996), a generation that largely came of age during the 2008 financial crisis, watched the housing bubble burst, and entered a workforce amid rising living costs. For them, all these factors made saving and investing feel daunting. Despite—or perhaps because of—the circumstances they went through, millennials tend to be more flexible in their approach to building wealth and are more likely to embrace new investment strategies.

While baby boomers tend to favor traditional methods of growing wealth (like 401(k)s and stock market investing), Millennials are all about diversification and using their experiences—like navigating real estate or starting multiple income streams—to build financial security and family wealth for themselves and their beneficiaries.

Graham Kuzia, 39, senior manager at a Fortune 10 company, took the lessons passed down from his father and applied them to his own life. As a child, Graham learned the ins and outs of the stock market and other financial practices from his father.

“Every day we’d look at the newspaper and follow certain stocks so that I could learn how they go up and down,” explains Graham. “Even though my father was a mechanic and didn’t have a whole bunch of financial investing experience, it was important for him to teach me about the market.”

But Graham didn’t stop there. After college, he began investing in his 401(k) and ventured into real estate, buying properties with his wife. According to Schwab’s High Net Worth Investor Survey, three in five wealthy Americans who intend to pass on wealth say they started planning their wealth transfer before the age of 45. Graham is no exception here—his shared goal with his wife is to build a foundation that will provide for their daughters, who are six and nine years old, in the future.

“They see us doing work at the rental properties. When we went to look at the houses and put in offers, they came with us. So, we’re trying to start that [education] from a young age,” he said.

As a self-proclaimed early-retiree-in-the-making, Graham’s ambitious goal is to retire by 50. It’s not just about accumulating wealth; it’s about building a life where he doesn’t have to work longer than necessary. And yes, he’s already talking about financial planning with his daughters. “I’ve always wanted to teach them about it too. I try to teach them about the basics of finance and money and how it works, even though they’re still really young,” he said.

Millennials are thinking about wealth-building earlier in life with a focus on long-term investments that go beyond stocks—including real estate, passive income, and even the pursuit of financial freedom and early retirement. Part of the reason for this creative pursuit of financial freedom is to set their next generation up for financial success sooner rather than later, so they are prepared to weather any uncertain economic times and get a leg ahead.

The estate planning conversation: timing is everything

While millennials may have a more modern approach, baby boomers still hold most of the wealth. So, when it comes to the transfer of wealth, timing is everything. Baby boomers are increasingly aware that their kids are juggling their own financial struggles, and many are looking for ways to transfer wealth more efficiently.

“How one plans for their future needs, opportunities, and outcomes is predicated on philosophy,” Charlie said. “I choose a philosophy that centers on a vision of hopes and desires for not only myself but for my family.”

Graham’s strategy is all about taking action and using multiple sources of income and financial assets to build wealth, which is something he’s even begun educating his parents on. “The tables have turned, and I give my dad financial advice now, which is kind of cool and full circle.”

Amid the generational differences, it’s clear that both groups are focused on one key thing: providing a solid financial foundation for their loved ones. Their methods may differ, but the goal remains the same.

So, whether you’re from an older generation looking to distill wisdom for your future generations or a younger generation striving to teach early investing lessons to get ahead, both approaches reflect a shared desire: to build a lasting legacy that empowers the next generation.