Transcript: May Day

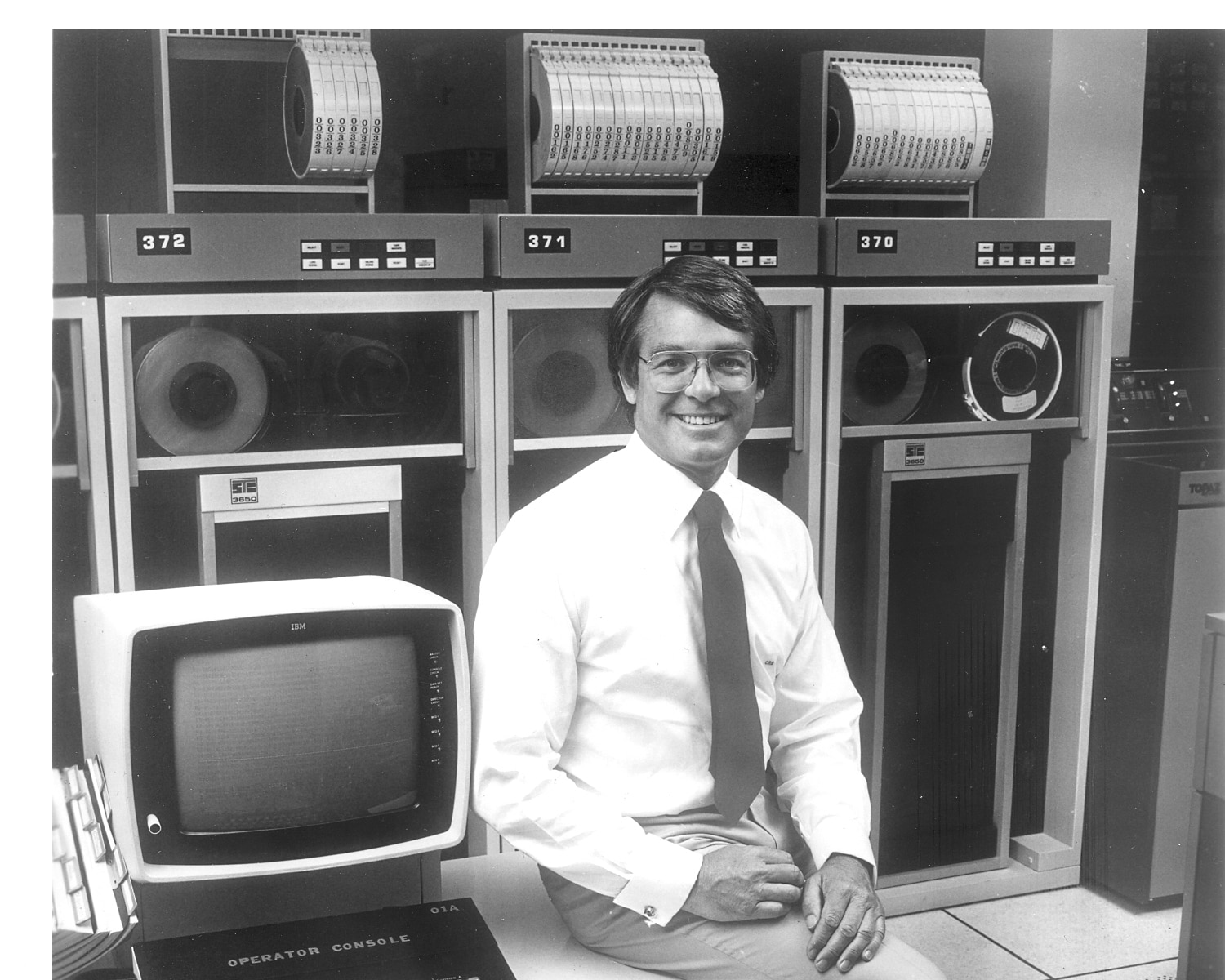

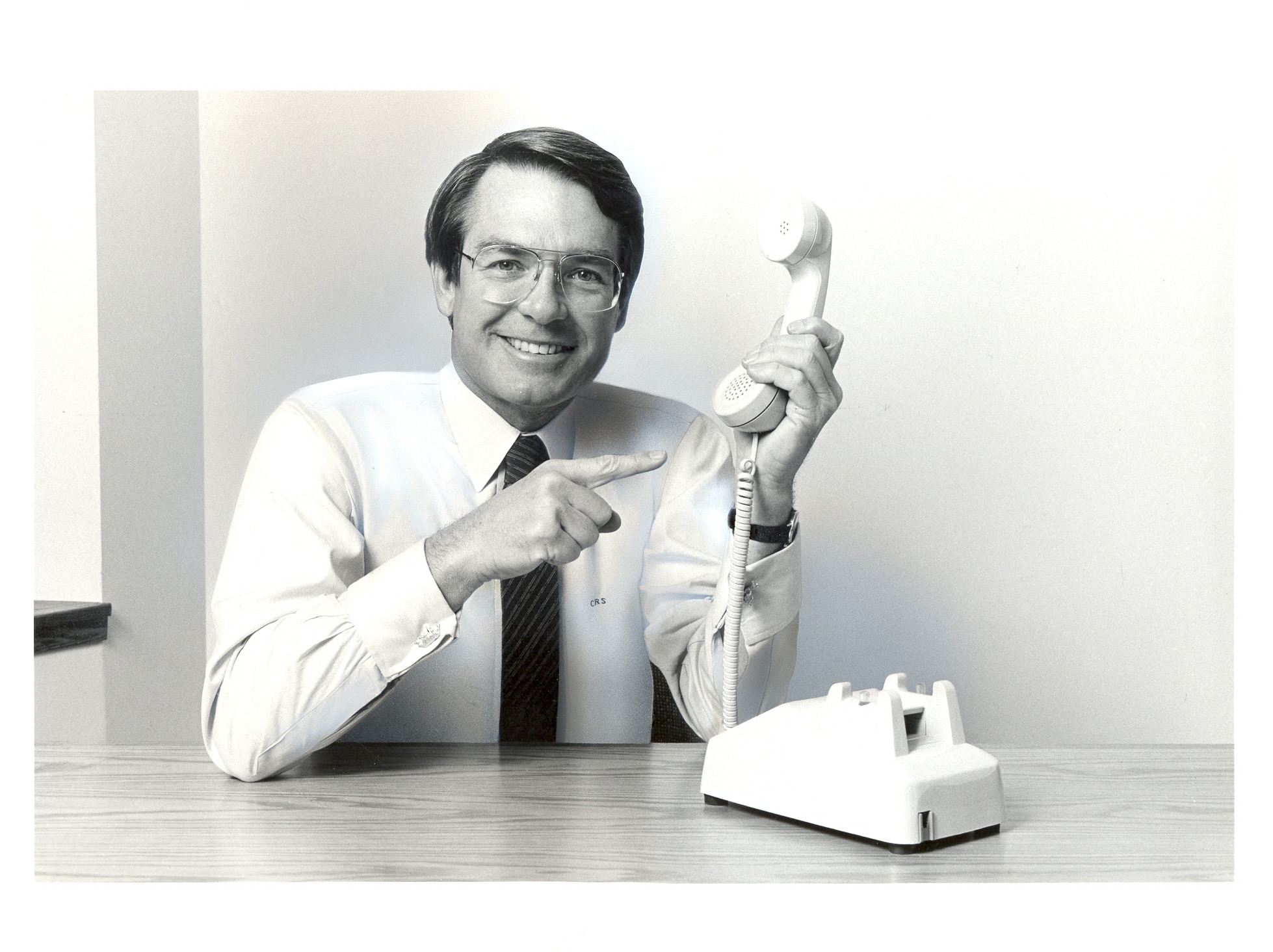

Charles Schwab: Oh, my god. There I am.

These are sort of tinted, but I'll put them on. There I am. My prescription's changed a little bit, but this is basically what I looked like. However, my hair was a little bit of different color. Back in '75. It was very brown.

Wall Street, they're huge. They had all the money. That's where all the money was in the United States, sitting around Wall Street. I was an analyst and a portfolio manager, so I began really understanding the brokerage industry as such. What I didn't want to be.

Brokers were basically selling stories. The broker would run into you someplace and sell you, say, "Hey, I got a really good idea for you. It's going to go to the moon. You'd better hop on." Inside information was rampant then.

Speaker 2: Relax, will you? Believe me, you made the right move.

Speaker 3: You really think so?

Speaker 2: Why, sure. We got the inside track.

Charles Schwab: Some people would call that being a con man. That was the industry. There was fixed prices so extraordinary high only the wealthiest people in the world could participate. It was a highly conflicted business. I wanted to have a firm that was free of the huge conflicts that I saw in the business, so I started Charles Schwab & Company.

I was a pariah, oh, for sure. I was this little guy on the West Coast, and access to capital for me was a fundamental problem because I couldn't access Wall Street. They didn't want to finance their competitor. I mortgaged my house. You name it. I went to relatives, I went to friends. "I hope Chuck doesn't come and ask me for money, because it's just not what I want to do." They regretted it later on.

The magic moment: May 1 of '75; May Day. Congress passed laws to outlaw fixed commissions. In essence, really democratize the business, bring it open to anybody. If you got $100, you're in. Article was in the paper, Merrill Lynch raised their rates. I was very happy that day, because I would've thought that Merrill would've dropped their rates substantially and we would've had no business. But we dropped our rates 50%, 60%, something like that, and it just created a huge opportunity for us to take our little business and grow it like crazy.

We were growing so fast, we wanted to get everybody in.

We didn't incentivize our people. One way or another, they all made salaries. That was really revolutionary. Here was this little guy from the West Coast, undermining Wall Street.

I hope we are, continue to be, agents of change for the better. Just treat people like you'd like to be treated. It's pretty simple. Not a big something from the top of the mountain; it's right there.

Anyway, it's all true.