Modern Wealth Index 2017

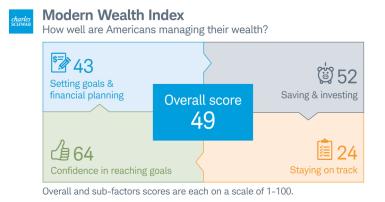

The Modern Wealth Index tracks how well Americans across the wealth spectrum are planning, managing, and engaging with their wealth.

Developed in partnership with Koski Research and the Schwab Center for Financial Research, the Modern Wealth Index is based on Schwab’s investing principles and composed of 60 financial behaviors and attitudes—each assigned a varying amount of points depending on their importance.

The Index broadly assesses Americans across four factors:

- Goal setting and financial planning

- Saving and investing

- Staying on track

- Confidence in reaching financial goals

Based on the total number of points received, respondents were indexed on a 1–100 scale for each of the four factors and an overall score. Read the national press release

View The National Survey Findings

Infographic: What It Takes To Be Wealthy In 10 American Cities

Infographic: what it takes to be wealthy in 10 American cities

Here's how residents in 10 American cities responded when asked how much is required to be considered "wealthy" and "financially comfortable" in their cities.

Key national findings: Finding #1:

Americans are split on their definitions of wealth according to new research from Charles Schwab, with some describing wealth as a specific sum of money and others describing it more as a state of mind.

Finding #2:

On a scale of 1–100, Americans received an average Modern Wealth Index score of 49. Among the four factors of the Index, Americans score highest when it comes to confidence in reaching their goals, while staying on track was the largest drag on the overall index score.

Finding #3:

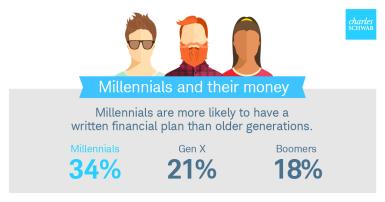

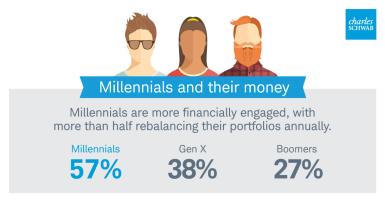

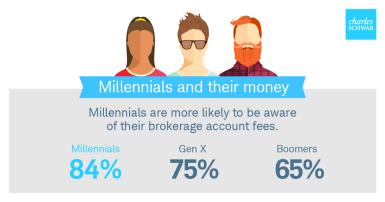

Millennials model some of the best financial habits in comparison to older generations.

Finding #4:

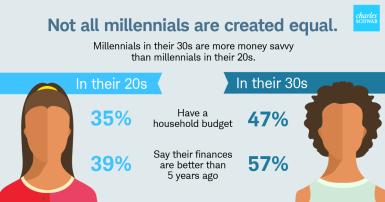

As millennials age, their habits tend to improve.

Through its operating subsidiaries, The Charles Schwab Corporation (NYSE: SCHW) provides a full range of securities brokerage, banking, money management, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC), and affiliates offer a complete range of investment services and products, including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; compliance and trade monitoring solutions; referrals to independent fee-based investment advisors; and custodial, operational and trading support for independent fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc. Koski Research is not affiliated with the Charles Schwab Corporation or its affiliates. More information is available at www.schwab.com and www.aboutschwab.com.