Inflation, personal debt, increased interest rates, stock market volatility—the triggers of financial stress loom large. And people are feeling the pressure. More than 40% of Americans say money is taking a toll on their mental health, at least occasionally causing anxiety, stress, loss of sleep, and depression, according to Bankrate. The current landscape might actually be shifting the very definition of financial health: The 2025 Charles Schwab Modern Wealth Survey reveals 63% of Americans believe it takes more money to be wealthy in 2025, and only 20% say they’re financially comfortable today.

For certain people, the antidote is going all in on saving money or stress saving: compulsively squirreling away funds out of sheer panic. “Stress saving is something that makes sense to us when we have unknowns in our financial life,” says financial therapist Amanda Clayman.

Yet while saving is undoubtedly a sound habit—and one that many people struggle to build—making decisions out of fear can add unnecessary strain. You often forego opportunities to invest and grow your wealth. Or you might just miss out on fun, making unnecessarily frugal choices that can diminish your quality of life.

Signs of stress saving

For those prone to stress saving (or other actions that could be tied to larger money dysmorphia behaviors), the urge might increase during periods of economic uncertainty. And it often goes back to our childhood experiences, says Danielle Labotka, a behavioral scientist at Morningstar. A person might have grown up in a household that had money stress like constantly struggling to pay bills, for example.

Identifying and understanding those experiences as a source of stress can help you shift your mindset—and the associated behavior, Amanda says. She suggests looking for emotional triggers that might prompt stress saving behavior. Decision-making that seems rational in isolation may actually be part of a troublesome, long-term pattern.

Some signs of stress saving include maintaining an excessively high balance in your savings account or obsessively increasing your savings goal without a real reason. A more balanced approach is to set aside three to six months’ worth of expenses in an emergency fund you can easily access. If you’re providing for dependents, or if you have unstable income or limited job security, you might need more. But establishing a specific threshold at which you’d consider your emergency savings fully funded helps eliminate alarm bells that might push you toward saving more than you need.

When stress saving goes too far

Stress saving isn’t all bad. Stashing extra cash can be an effective way to alleviate anxiety—while also providing protection from future bumps in the road. “We might be doing something for an emotional reason that still has a benefit for us later,” says Amanda.

But there are limits. A major downside to a save-at-all-costs approach is that you might be missing out on the opportunity to make progress on other important financial goals. For example, you might be better off using extra cash for high-interest debt repayments or to max out retirement contributions.

Hoarding money that you’ve worked so hard to save in a bank account could also mean you’re missing out on traveling, spending time with family and friends, or investing in your hobbies. And according to the Modern Wealth survey, these life experiences are valuable—Americans revealed that happiness (45%) was just as important as the amount of money they have (44%) when it comes to defining personal wealth.

Stress saving can limit your long-term investments, too. Over time, inflation eats away at the purchasing power of your cash. So if you have funds you won’t need for immediate goals or an emergency, you’re better off investing them or saving them for use later, or for retirement savings. You’ll likely enjoy better returns that also benefit from compound growth over time.

Need another reason to avoid stress saving? It can be hard to sustain. Once the external urge to save dissipates, stress savers might abandon the habit entirely or give in to temptation and go on a spending splurge, Amanda says.

Source: 2025 Charles Schwab Modern Wealth Survey

How to strike the right savings balance

Instead of saving as a stress response, focus on efforts that will help you accomplish your larger financial goals. The good news? Some of the same strategies for curbing overspending can also help you stop stress saving. For example, making a monthly budget can give you a more realistic sense of how your daily life spending habits align with your income to determine how much money you need to save. If you’re already living well below your means, you can feel less guilty adding lines for leisure activities or an occasional treat-yourself moment, knowing you aren’t sacrificing your financial future.

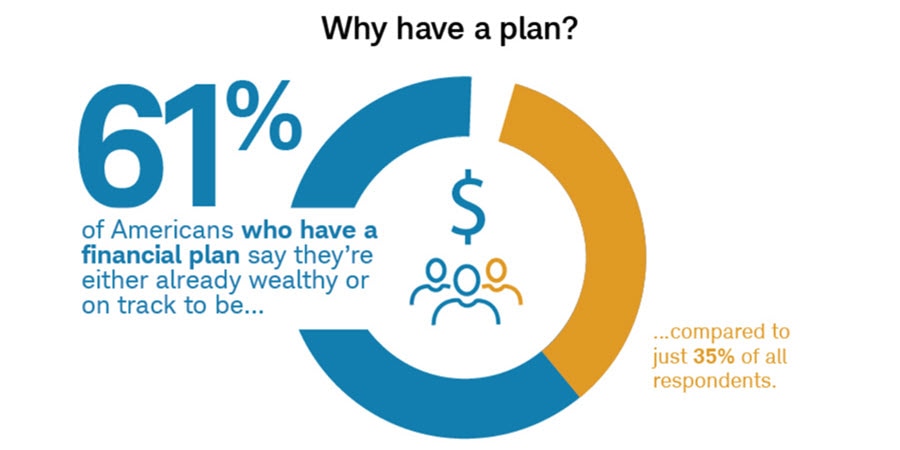

Your budget can also help determine a realistic savings goal. And that’s a good first step toward establishing a financial plan that takes into account your long-term financial ambitions and puts your extra cash to work for you. Roughly 6 in 10 Americans (61%) who have a financial plan say they’re either already wealthy or on track to be so, compared to just 35% of all Americans, according to Schwab’s survey.

“You want to have a clear endpoint for your savings,” says Danielle. “It’s great to have saved for an emergency, but you need to know what number you’re working toward.”

You’ll want to revisit your money management playbook occasionally as your lifestyle, milestones, and income shift over time, of course. Building in flexibility to account for unexpected expenses helps ensure you can stick to your plan and keep your stress levels, stress saving, and overall well-being in check.

“It’s much more effective to be saving from a place of proactivity as opposed to reactivity,” Danielle says. “We know that people who have clearly defined goals are more likely to follow through with the plans they have in place.”

You should still be putting money into your savings fund, but do it strategically. Going in with a plan will give you peace of mind—and then you don’t need to fret over splurging on a new pair of sneakers or a trip to New York.